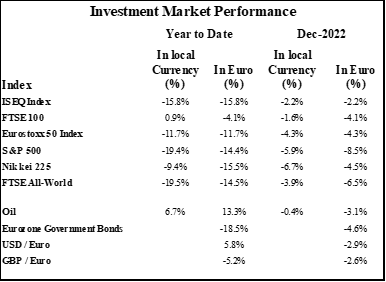

2022 was an exceptionally difficult year for investment markets with the three main asset classes, equities, bonds and real estate all posting significant declines. For stockmarkets it was the worst year since the financial crisis in 2008, while bonds posted their biggest loss in more than a generation. A range of factors combined in the first half of the year to cause a surge in price inflation. Continuing strict covid-19 lockdowns in China disrupted the supply of manufactured goods and components for much of 2022, while Russia’s invasion of Ukraine in February and the resulting sanctions on Russian exports caused sharp increases in energy and food commodity prices. By mid year all of the main central banks were indicating relatively aggressive interest rate increases to control inflation. This had a significant impact on bond and stock markets.

FTSE World Global Equity Index (in euro terms), last 12 months

Source: Bloomberg

Inflation Outlook

The direction of Central Bank policy will remain a key driver of markets in the first half of 2023. While the main central banks (Fed and ECB) have made no suggestion to date of any easing in monetary policy, there are growing signs that the sharp increase in interest rates over the last six months are having the desired effect in cooling pricing pressures. Unemployment levels in the US remain at historic lows but there are numerous indicators of a slowing economy. Services inflation has reflected the rise in wages, with core services inflation at 6.8% in November. However, the Job Openings and Labour Turnover Survey (JOLTS), a leading indicator of the US labour market, suggested slowing demand for workers while the number of Americans leaving their jobs voluntarily fell to the lowest level in 17 months. The number of major companies laying off staff is also rising, with Goldman Sachs recently announcing they would reduce their headcount by 8%. Major employers such as Amazon, Twitter, Google and Meta are already laying off staff while most tech companies have imposed hiring freezes.

US Job Openings

Source: Bloomberg

Energy prices remain a key factor in the outlook for inflation. High base effects due to the surge in oil prices in Q1 2022 will see energy become a negative contributor to annual inflation readings from February assuming prices remain at current levels. Oil prices are down almost 37% from the high in March 2022. The fall in commodity prices has been widespread. The Bloomberg Commodity Index, which has 23 commodity futures across 6 sectors, has fallen 18% since June. Prices for agricultural commodities such as corn, soybean and wheat have also fallen considerably with the index of agricultural commodities down 15% since its peak in mid-May.

Bloomberg Commodity Index (white) and US Inflation (blue)

Source: Bloomberg

Both the Federal Reserve and the ECB have been steadfast in their commitment to continue increasing interest rates until inflation is fully contained at their target levels. While recent annual inflation readings remain high, much of this is due to the surge in commodities and manufactured goods pricing from H1 2022 and these will drop out of the annual data over the coming months. Wage inflation remains elevated but there are growing signs that pressure in the labour market is easing with a sharp slowdown in hiring towards the end of the year. The sharp fall in equity markets has effectively priced in a recession in H1 2023 and we expect to see a sharp slowdown in aggregate demand across the global economy in the opening months of the year which should see wage pressures ease significantly.

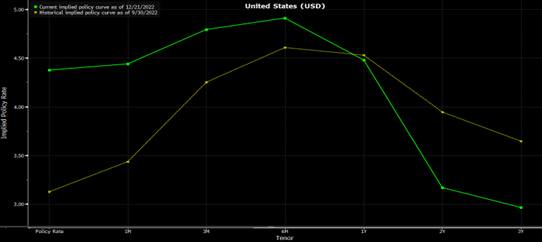

Implied US Policy Rate (green) vs Implied Rate at end Q3 2022 (yellow)

Source: Bloomberg

The sharp rise in interest rates globally has posed a significant challenge for bond, equity and real estate investors in 2022. Inflationary pressures are already easing and as we go through Q1 2023 base effects will see a sharp fall in annual inflation readings. Last year’s events in investment markets will be reflected in the real economy in 2023 with many economists anticipating recession in much of the developed world over the next six months. Interest rate policy will have to adjust quickly in 2023 to the more benign inflationary outlook and further interest rate increases will likely be limited, with the Federal Reserve expected to start reversing some increases by the second half of the year.

Equity Market Outlook– Earnings Decline but How Much is Priced In?

US equities fell 19.4% in 2023 with the technology sector suffering the most severe falls – the Nasdaq fell 33%. While some pull back in stock prices was expected given the exceptional returns from stocks in 2021, the surge in price inflation in H1 2022 and the resulting rise in interest rates caught markets by surprise. The rapid increase in interest rates resulted in an aggressive de-rating in asset prices – especially those valued purely on the basis of discounted cash flows (bonds and listed real estate). Technology shares which benefitted from pandemic lockdowns saw much of their gains of the previous two years unwound as growth projections were dramatically revised under the new higher interest rate environment while equity markets moved to price in a likely recession in 2023.

US equity markets are now trading at 16.6 times forward earnings, having traded as high as 25 times earnings a year ago. Corporate profits themselves are also now projected to decline for the S&P 500 largely due to a sharp slowdown in the technology sector. Higher interest rates mean that equity market valuation multiples should be lower but at this stage it does appear that interest increases are almost done, and we expect this risk to be less of a feature in 2023.

Earnings (white) growth likely to contract in 2023. PE ratio (red) and US 10- Year Yield ( yellow, reversed)

Source: Bloomberg

The 20% fall in US equities anticipates a period of economic recession in 2023 which will see Central Banks moving away from interest rate increases and possibly cutting interest rates at some stage later in the year to restart the cycle. The depth of this recession will determine the path for stocks over the coming months. In general, however, our view is that because Central Banks have effectively managed the slowdown in economic activity to control inflation, they are more in control of events than in the last two cycles. There is, therefore, no reason to believe that the economic slowdown will be any worse than that currently projected by equity market pricing. Corporate earnings for the stocks that make up global equity indices are, overall, relatively defensive due to the diversification across different sectors and the relatively high weightings in stocks that typically hold up well through economic downturns (technology, pharma, energy, etc.). While technology shares have borne the brunt of the equity market falls in 2022, the aggressive cost cutting we have seen across the larger firms in H2 2022 will support profits in the coming years for most of these.

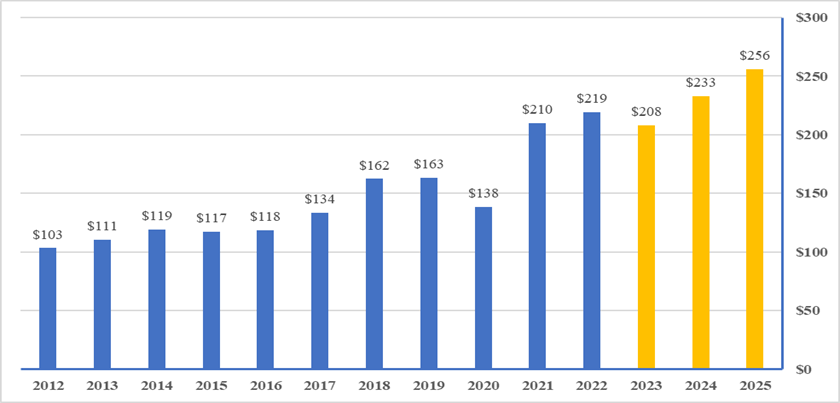

Most commentaries are suggesting a 5% fall in S&P 500 earnings per share in 2023. In our view, this seems reasonable. Applying some expansion in P/E multiples as interest rate increases disappear, a 5% fall in earnings would support upside in US stock prices of 5-10% in 2023. A recovery in the economy and in turn in corporate earnings in H2 2023 and 2024 implies more upside for stock prices.

S&P 500 Earnings – Forecasts in Orange

Source: Bloomberg, JP Morgan, Goldman Sachs, UBS

Equity market investing is a long term game. Over the past three years markets have seen exceptionally high volatility with significant gains in 2021 following by a sharp fall in 2022 following the dramatic events that have dominated the news headlines over that period. The depth of the economic slowdown anticipated by the stock market weakness in 2022 will determine the returns from equities over the coming months. As the slowdown has effectively been manufactured by Central Banks to control price inflation, we believe that any recession will be relatively shallow and Central Banks will continue to deploy monetary policy as appropriate to manage events. The large falls in technology stock prices especially in more speculative stocks with very high multiples, or which have yet to make a profit, is healthy in removing the excesses that inevitably appear in markets when money is too cheap for too long. Our outlook for equities in 2023 is, therefore, that returns will be more in line with the longer term average of 4 – 5% above deposit rates.

Wellesley Investments & Pensions Ltd.

09/01/2023

This Research Note has been prepared by Wellesley Investments & Pensions Ltd. on the basis of publicly available information, internally developed data and other sources believed to be reliable. While all reasonable care has been taken in the preparation of this document, we do not guarantee the accuracy or completeness of the information contained therein. Any opinion expressed (including estimates and forecasts) may be subject to change without notice.

The information presented in this Research Note is provided for information purposes only and is not to be used or considered as an offer or the solicitation of an offer to sell or to buy or to subscribe for securities. We or any of our connected or affiliated companies or their employees may have a position in any of the securities or may have provided, within the last twelve months, significant advice or investment services in relation to any of the securities or related investments referred to in this document. Nothing in this Research Note constitutes investment advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances, or otherwise constitutes a personal recommendation to you. The value of investments can fall as well as rise and there is no guarantee that investors will receive back their capital invested. Past performance and simulated performance is not a reliable guide to future performance. Projected returns are estimates only and are not a reliable guide to the future performance of an investment.

While reasonable care has been taken in the preparation of this Research Note, no warranty or representation, express or implied, is or will be provided by Wellesley Investments & Pensions Ltd. or any of its shareholders or affiliated entities, all of whom expressly disclaim any and all liability for the contents of, or omissions from, the research provided, the information or opinions on which it is based and/or whether it is a reasonable summary of the securities in the research.

All material presented in this publication is copyright to Wellesley Investments & Pensions Ltd. None of the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party without the prior express written permission of Wellesley Investments & Pensions Ltd.

Wellesley Investments & Pensions Ltd. is regulated by the Central Bank of Ireland.